Do you ever find yourself strapped for cash before payday rolls around? Many people live paycheck to paycheck and struggle to bridge the gap when unexpected expenses arise.

The good news is that several apps now provide free or low-cost pillow contrivances to give you some financial breathing room.

These advances allow access to earned wages, helping you cover costs until your next paycheck without resorting to predatory payday loans.

This article will explore 11 of the best cash advance apps. We'll overview how each works, features, fees, and more so you can determine if one may be a good emergency option when your bank account runs low.

What Exactly is a Paycheck Advance and How Does it Work?

A paycheck advance app lets you access earned wages before the official payday.

For example, if payday is Friday but you face an unexpected bill on Wednesday, you could get part of that Friday paycheck transferred a few days early.

The app connects to your payroll and bank account. On payday, it automatically deducts what you advance to repay itself.

The key benefit is accessing earned money for free or cheaply, compared to pricey payday loans. Just be careful not to rely on advances or outspend future paychecks overly.

Why Should You Consider a Pay Advance App Over Riskier Alternatives?

Pay advance apps let you access the money you've already earned for free or a small fee before payday. This can help avoid late fees, bounced checks, and payday loans that snowball expenses.

While getting advances often is risky, having the option of an emergency safety net is wise. Payday loans charge crazy rates for money you don't have yet. But pay advances and access money coming in your next check.

Pay advance app aid during true emergencies to dodge steep fees and traps. Use sparingly and only if needed.

11 Best Paycheck Advance Apps

Do you understand what paycheck advance apps offer? Let's explore some top options to consider if you could benefit from access to your pay sooner.

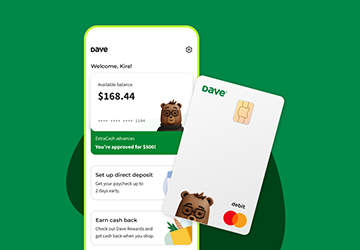

1.Dave

Dave makes getting a paycheck advance easy and affordable. For just $1 a month, you can get up to $250 sent to your account by the next day. Dave also helps you find side gigs and build emergency savings automatically.

2.Varo

With Varo, you can get your paycheck up to two days early. If you need extra cash before payday, you can get an advance of up to $250 with no fees. Varo offers premium accounts with cash-back rewards and tools to improve your finances.

3.Empower

Don't let a cash shortfall leave you powerless. With Empower, get advances up to $250 transferred instantly. The $8 monthly fee also gives you cash-back rewards from leading retailers and over 40,000 accessible ATMs nationwide.

4.Albert

Albert makes accessing your paycheck easy and rewarding. For a small price, you can get advances of up to $250 with no fees and instant access. You'll enjoy perks like automated budgeting, free cash back, and easy investing tools.

5.MoneyLion

Roar past payday struggles with MoneyLion. For $1-$5 a month, you get managed investing, credit assistance, cash-back rewards and instant transfers up to $500 when needed. It's financial help made simple.

6.FloatMe

If you're short on funds, have your employer FloatMe your next paycheck. Using this convenient automated service, you can instantly access up to $50 of earnings with no monthly fees or interest.

7.PayActive

PayActive lets you tap your upcoming paycheck today so bills don't stay caught up. You can access up to half of your earnings instantly for a small fee. You'll also enjoy discounts and financial guidance when signed up through work.

8.DailyPay

Get paid on any day, like payday. DailyPay securely accesses earned wages whenever you need them with instant transfers. Avoid payday loans and bounce back faster from surprise expenses.

9.Branch

Branch out beyond paycheck limitations. This app partners with employers to give fast, free access to up to $150 of your next check. Use it to cover gaps between pay periods without fees or interest.

10.Earnin'

With Earnin, every day can feel like a payday. Get up to $100 daily with instant transfers at no cost. While tips are appreciated, you decide what you can afford. Innovative tools also help avoid overdrafts.

11.Brigit

Don't let bills pile up! Brigit offers paycheck advances up to $250 to catch up. While monthly fees apply, you get financial safety nets like automated advances to stop overdrafts in their tracks.

The Bottom Line

If you occasionally face a cash shortfall between paychecks, pay advance apps provide secure access to money already earned.

They serve as a much safer alternative to options like payday loans or paying fees for overdrafts or late bills.

Just be cautious not to overly rely on pay advances and carefully consider your financial situation first. With discipline, they offer a nice cash flow safety net for genuine emergencies.